Investors

Sandbox Royalties offers investors a unique opportunity in the royalty space. Diversified across a range of metals types including precious metals, industrial metals, and critical materials, Sandbox has a growing portfolio of producing and development stage royalties. Backed by two of the preeminent mining industry leaders, Sandstorm Gold Royalties and Equinox Gold, Sandbox Royalties has an aggressive growth strategy in place.

Our strategic priorities for unlocking value

A partnership of industry leaders

Sandbox was created through the partnership of its founding shareholders, Equinox Gold and Sandstorm Gold Royalties, both multi-billion dollar leaders in the mining and royalty industries. These strategic relationships offer Sandbox:

- Initial portfolio of royalty assets and access to robust deal flow

- Industry-leading experience, connectivity and technical expertise

- Partnership opportunities on future acquisitions and a Right of First Offer on all Equinox Gold divestitures any time after a go-public transaction by Sandbox

Highlights

Diversified portfolio of existing royalties

Significant existing mineral resource inventory includes gold, silver, copper, zinc, graphite, and uranium in mining-friendly jurisdictions.

Attractive commodity exposure

A natural inflation and geopolitical hedge with diversified commodity, country and asset-specific risk.

Quality sponsorship aligned for success

Founding shareholders are industry leaders with ability to support deal flow, technical diligence and access to capital.

High-margin, scalable model

Building scale through high-margin royalty acquisitions with a focus on cash flow, optionality and diversification.

An aggressive corporate development strategy is underway to grow Sandbox’s asset base

Near-term Acquisition Criteria:

- Cash-flowing or near-term production with fixed near-term payments, where feasible

- Accretive on a per-share basis with estimated IRR commensurate with risk profile

- Financially viable operations in mining-friendly jurisdictions with strong operators

- Optionality through exploration and expansion

- Adherence to sustainable mining principles assessing all components of ESG

Investor Presentation

Download our most recent investor presentation for a more detailed look at what sets Sandbox Royalties apart from other royalty investments.

Download PresentationMarket Information

Gold US$/oz

Silver US$/oz

Copper US$/lb

Source: Financial Modeling

Capital Structure

| Share Structure | As at Dec, 2023 |

|---|---|

| Shares Outstanding | 269M |

| Market Capitalization @ $0.70/share | 139M |

| RCF Outstanding | $26 |

| Beedie Capital Convertable Loan1 | $16M |

| Sandstorm Convertable Note2 | $17M |

| Pro Forma Cash | $6M |

| Total Enterprise Value | $192M |

Note: All prices listed in $USD

1. Favourable loan terms on convertible loans: 60-month term; 8.0% base interest (25-50% payable in shares): 1.0-1.5% PIK; Prepayable subject to interest protection period and fee; Convertible at C$0.84/share; Pro forma ownership post-conversion ~11%

1. Favourable debt terms on convertible notes: 10-year term; Non-interest bearing; Non-amortizing; Convertible at market price (C$0.70 floor price)

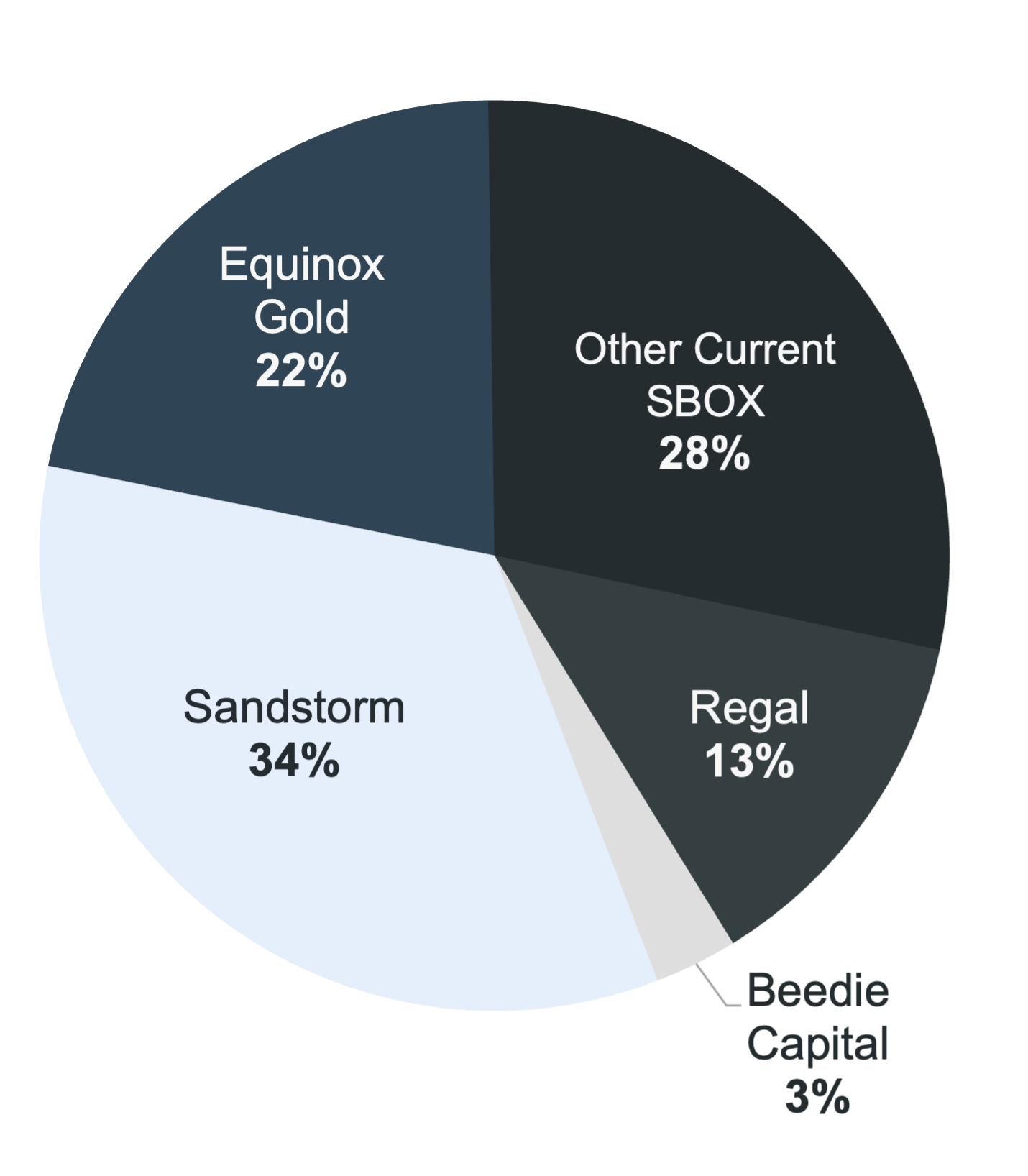

Shareholders

Stay in the know

Check out the latest news and updates from Sandbox Royalties. To ensure you stay up to date, be sure to sign up to our email list.

Recent News